south dakota vehicle sales tax exemption

The state of South Dakota levies a 4 state sales tax on the retail sale lease or rental of most goods and some services. To apply the certificate.

Car Sales Tax In South Dakota Getjerry Com

Motor vehicles exempt from the motor vehicle excise tax under SDCL 32-5B-2 are also exempt from sales tax.

. Not all states allow all exemptions listed on this form. Out-of-state vehicle titled option of licensing in. 13 rows In South Dakota certain items may be exempt from the sales tax to all consumers not just.

State sales tax of 4225 percent plus your local sales tax Document on the purchase price less trade-in allowance if any. Local jurisdictions impose additional sales taxes up to 2. Exemptions from Sales Tax.

Motor Vehicles EXEMPT In the state of South Dakota items are exempt from the general sales and use tax but are subject to separate. This includes the following see SDCL 32-5B-2 for a complete list. The first buyer is exempt if the dealer has paid the 4 excise tax and.

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a south dakota titled vehicle according to exemption 36. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The purchaser is a tax exempt entity.

This form can be downloaded on this page. 14-Any motor vehicle sold or transferred which is eleven or more model years old and which is sold or transferred for 2500 or less and. A vehicle is exempt from tax when it is transferred without consideration no money is exchanged between spouses between a parent and child and between siblings.

The South Dakota Streamlined Tax Agreement Certificate of Exemption is utilized for all exempted transactions. Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must. But this applies only to vehicles that you will not operate on.

Printable PDF South Dakota Sales Tax Datasheet. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. Sales of are exempt from the sales tax in South Dakota.

- Any motor vehicle sold or transferred that is eleven or more model years old. South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise. South dakota vehicle sales tax exemption Tuesday March 1 2022 The purchaser is a tax exempt entity.

Municipal governments in South Dakota are also. Registration license plate fees. This is a multi-state form.

This includes the following see SDL 32-5-2 for a complete list. There are limited situations where you can obtain a title without paying motor vehicle sales tax as a buyer. SDL 32-5-2 are also exempt from sales tax.

There are four reasons that products and services would be exempt from South Dakota sales tax. The vehicle is exempt from motor vehicle excise under SDCL 32-5B-2. There are hereby specifically exempted from the provisions of this chapter and from the computation of the amount of tax imposed by it the gross receipts from sales of tangible.

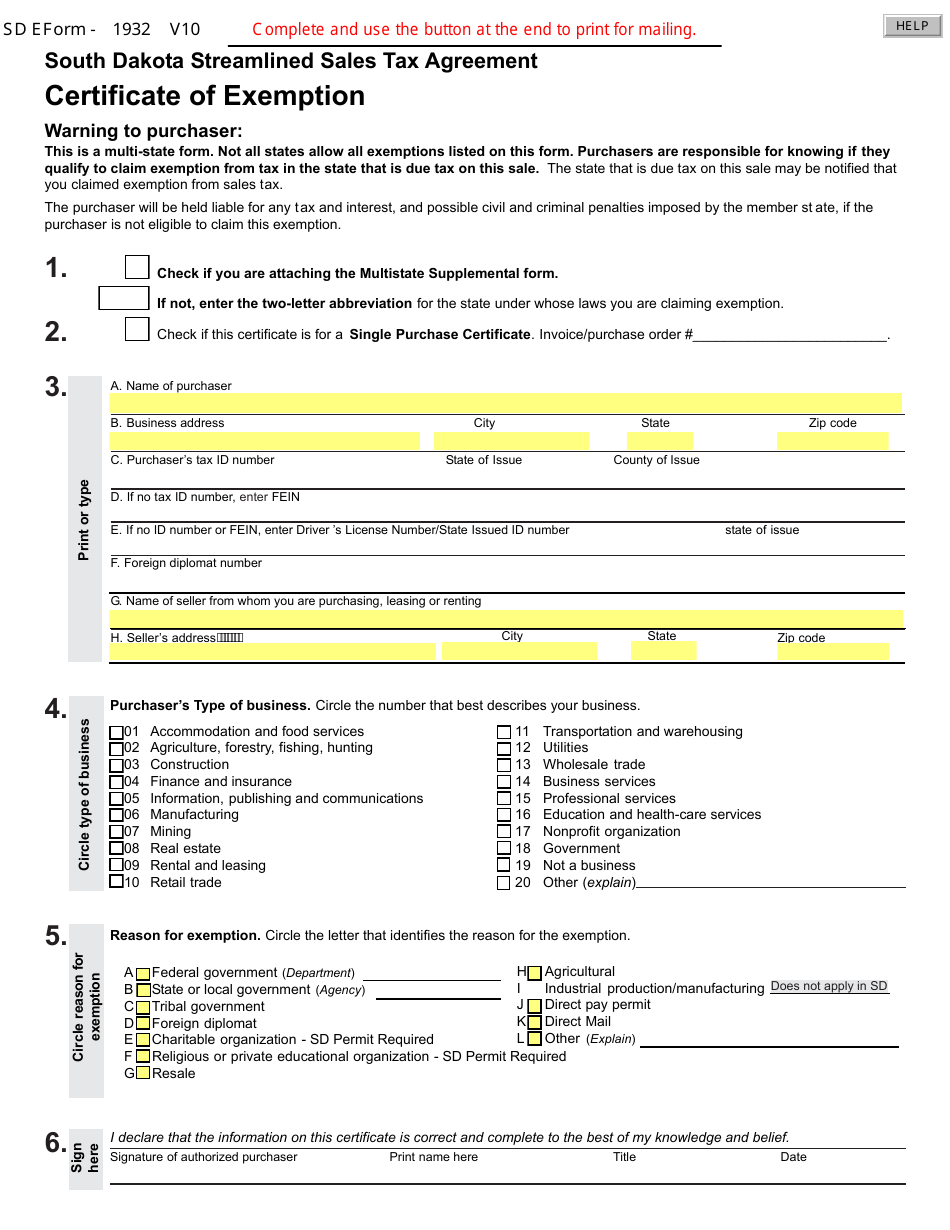

South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. South Dakota Vehicle Sales Tax Exemption.

The first buyer is exempt if the dealer has paid the 4 excise tax. The product or service is. This means that you save the sales taxes you would.

In South Dakota the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. Subject to either sales or use tax or motor vehicle excise tax unless exempt under SDCL 32-5B-2.

Taxing Flaring And The Politics Of State Methane Release Policy Rabe 2020 Review Of Policy Research Wiley Online Library

Form 1932 Download Fillable Pdf Or Fill Online Certificate Of Exemption South Dakota Templateroller

Form 1932 Download Fillable Pdf Or Fill Online Certificate Of Exemption South Dakota Templateroller

Car Sales Tax In South Dakota Getjerry Com

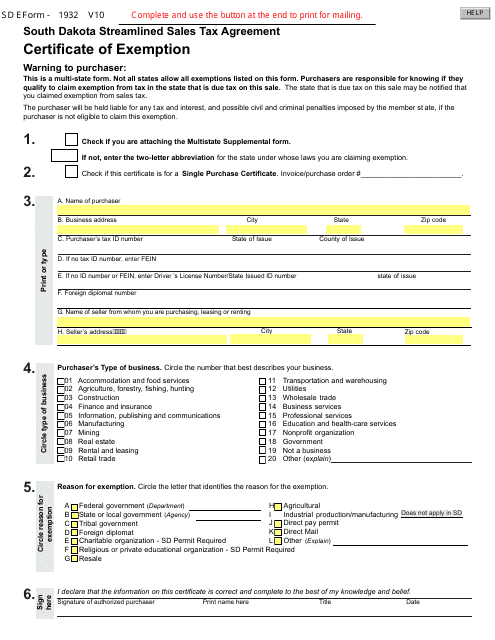

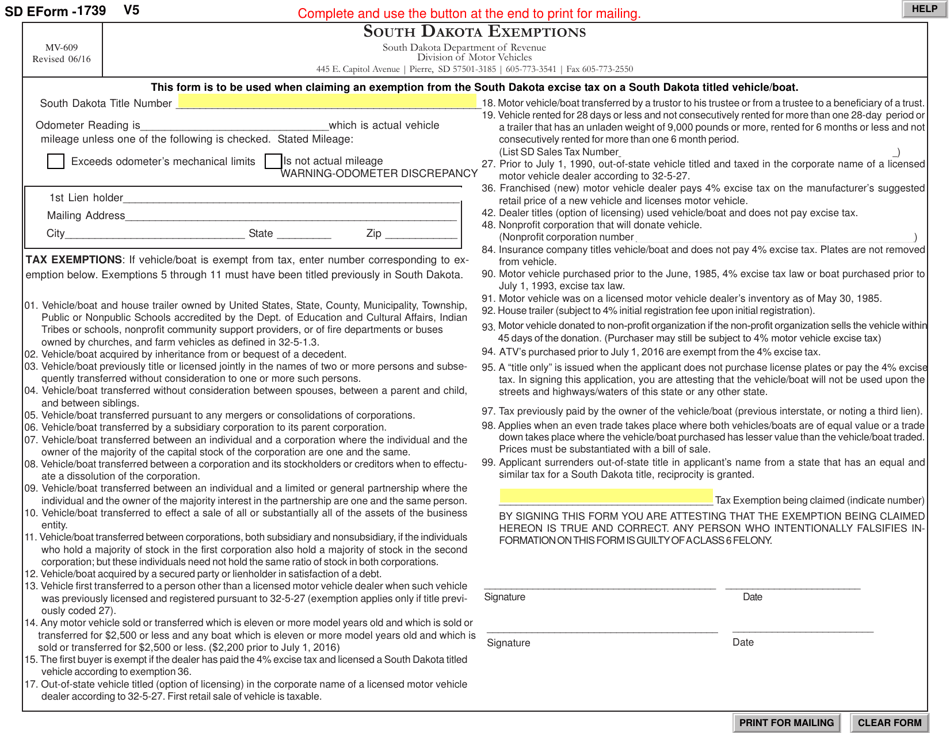

Sd Form 1739 Mv 609 Download Fillable Pdf Or Fill Online South Dakota Exemptions South Dakota Templateroller

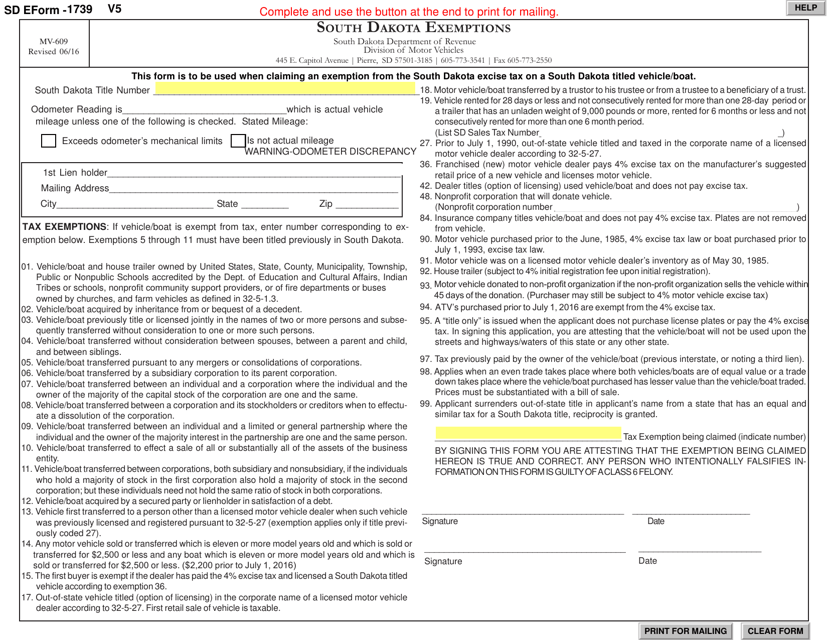

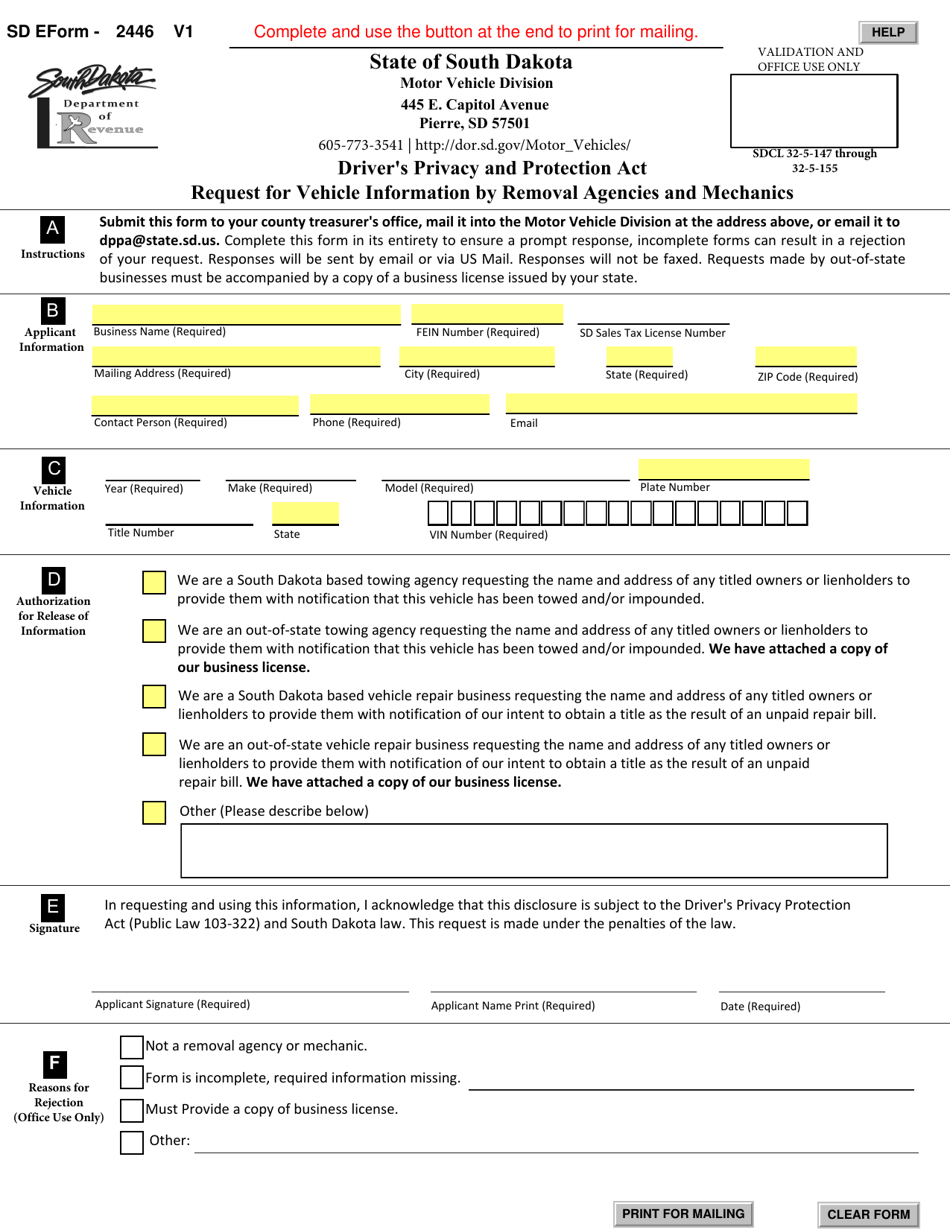

Sd Form 2446 Download Fillable Pdf Or Fill Online Request For Vehicle Information By Removal Agencies And Mechanics South Dakota Templateroller

Government Faqs South Dakota Department Of Revenue

Retirement Taxes By State 2021 Retirement Benefits Retirement Paying Taxes

Nj Car Sales Tax Everything You Need To Know

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

South Dakota Sales Tax Small Business Guide Truic

Car Sales Tax In South Dakota Getjerry Com

Sales Tax On Cars And Vehicles In South Dakota

Car Sales Tax In South Dakota Getjerry Com

Sd Form 1739 Mv 609 Download Fillable Pdf Or Fill Online South Dakota Exemptions South Dakota Templateroller

Sales Use Tax South Dakota Department Of Revenue

The Lab Leak Theory Inside The Fight To Uncover Covid 19 S Origins Vanity Fair